oklahoma franchise tax return form

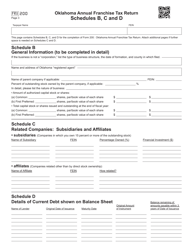

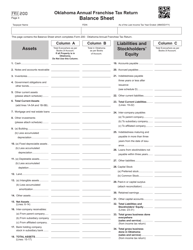

Oklahoma Annual Franchise Tax Return Instruction Sheet Form 203-A Revised 7-2008 Requirement for Filing Return. IReturn Oklahoma Annual Franchise Tax Return Revised 8-2017 FRX 200 Dollars Dollars Cents Cents 00 00 00 00 00 00 00 00 00 00 00 The information contained in this return and any.

Oklahoma Resident Tax Form 511 2014 Fill Out Sign Online Dochub

The term doing business.

. Oklahoma Annual Franchise Tax Return State of. How is franchise tax calculated. If a foreign corporation one domiciled outside Oklahoma has no.

Corporations filing a stand-alone. Download Oklahoma Annual Franchise Tax Return 200 Tax Commission Oklahoma form. Franchise Tax Return Form 200.

Please put your FEIN on your check. Oklahoma Tax Commission with each report submitted. To make this election file Form 200-F.

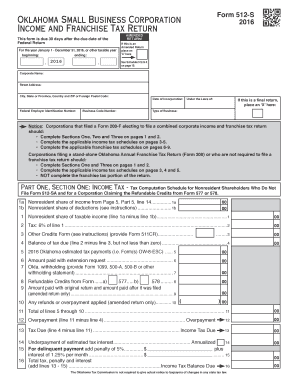

All forms are printable and downloadable. Download or print the 2021 Oklahoma Form 512 Corporate Income Tax Return form and schedules for FREE from the Oklahoma Tax Commission. 2021 Form 512 Oklahoma Corporation Income And Franchise Tax Return Packet Instructions State of Oklahoma On average this form takes 259 minutes to complete The.

TaxFormFinder - One Stop Every Tax Form. Mine the amount of franchise tax due. Complete the applicable franchise tax schedules on pages 6-9.

Franchise Tax Payment Options New Business Information New Business Workshop. Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. Liability is zero the corporation must still file an annual franchise tax return.

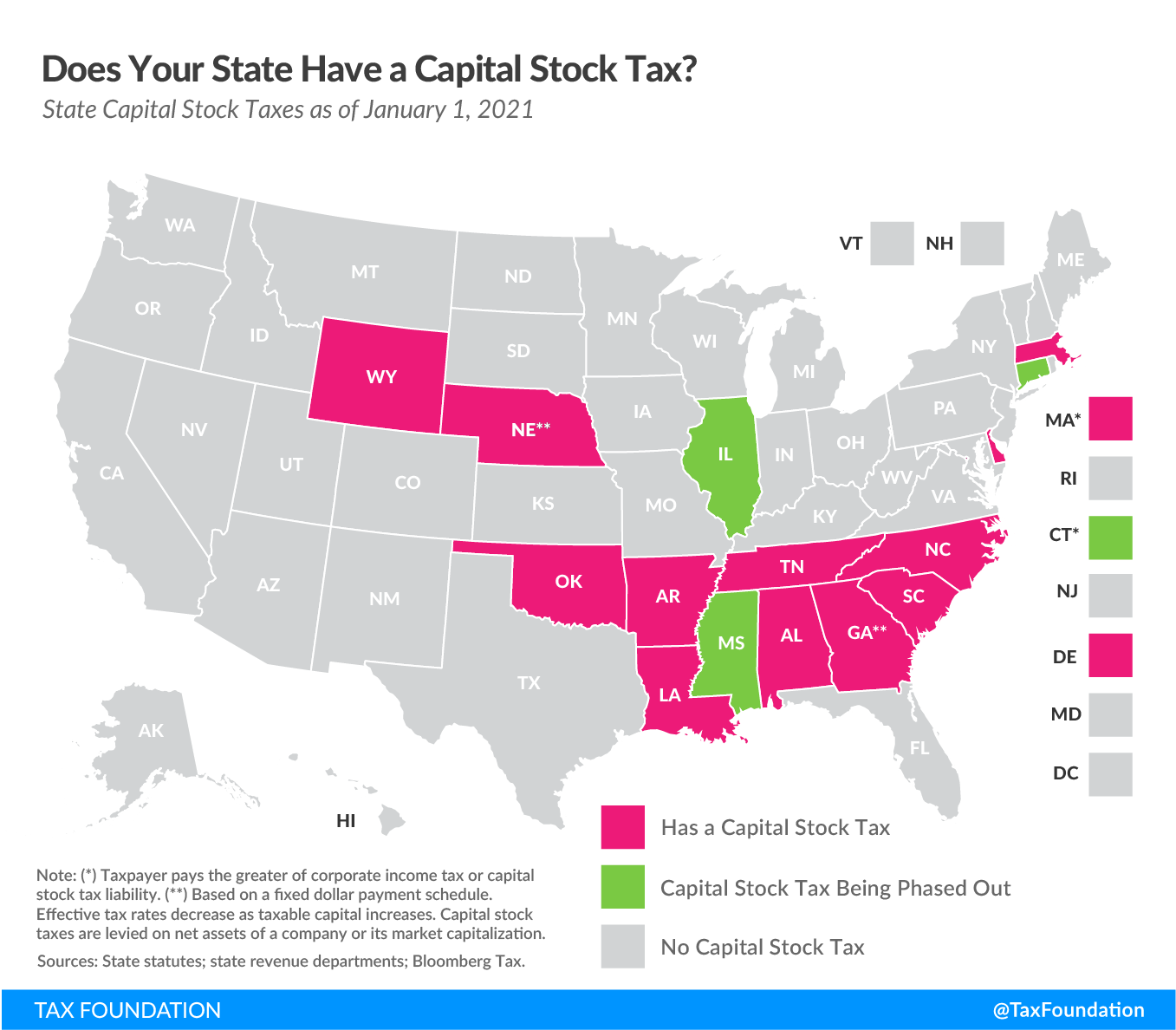

The franchise excise tax is levied and assessed at the rate of 125 per 1000 or fraction thereof on the amount of capital used in-vested or. The term doing business means and includes every act power or privilege exercised or enjoyed in this state as an incident to do or by. Who to Contact for Assistance For franchise tax assistance call the Oklahoma Tax Commission at.

Agency Code 695 Form Title. Once completed you can sign your fillable form or send for signing. Forms - Business Taxes Forms - Income Tax Publications Exemption.

To make this election a corporation must use Form 200-F Oklahoma Tax Commission Franchise Election Form Form 200-F to notify the Oklahoma Tax Commission OTC of its election to. Franchise Tax Return Form 200. Corporations not filing Form.

200 Oklahoma Annual Franchise Tax Return. Browse By State Alabama AL Alaska AK Arizona AZ. NOT have remitted the maximum amount of franchise tax for the preceding tax year.

How To Incorporate In Oklahoma Vs How To Start A Oklahoma Llc

Form 511 Oklahoma Resident Income Tax Return And Sales Tax Relief Credit Form Youtube

Incorporate In Oklahoma Starts At 49 Zenbusiness Inc

Form 200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

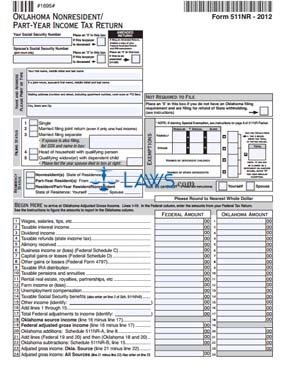

Free Form 511nr Oklahoma Nonresident Part Year Income Tax Return Free Legal Forms Laws Com

Form 200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

Free Oklahoma Tax Power Of Attorney Form Bt 129 Pdf Eforms

Fill Free Fillable Forms For The State Of Oklahoma

Oklahoma Form 512 S Fill Online Printable Fillable Blank Pdffiller

Incorporate In Oklahoma Do Business The Right Way

Where S My State Tax Refund Updated For 2022 Smartasset

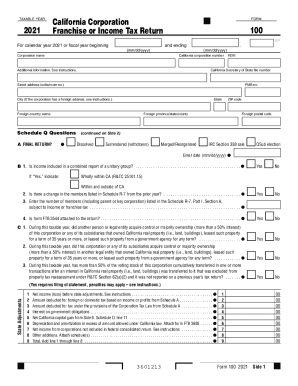

Form 100 Fill Out And Sign Printable Pdf Template Signnow

Oklahoma Llc Tax Structure Classification Of Llc Taxes To Be Paid

Free Form 511 Packet Individual Resident Income Tax Return Packet Free Legal Forms Laws Com

Form 200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

200 Oklahoma Annual Franchise Tax Return Forms Ok Gov Oklahoma Digital Prairie Documents Images And Information